1099 income tax calculator

When you receive form 1099-NEC it typically means you are self-employed and claim your income and deductions on your Schedule C which you use to calculate your net profits from self-employment. When you receive a refund offset or credit of state or local income tax that amount appears in box 2 of the 1099-G form.

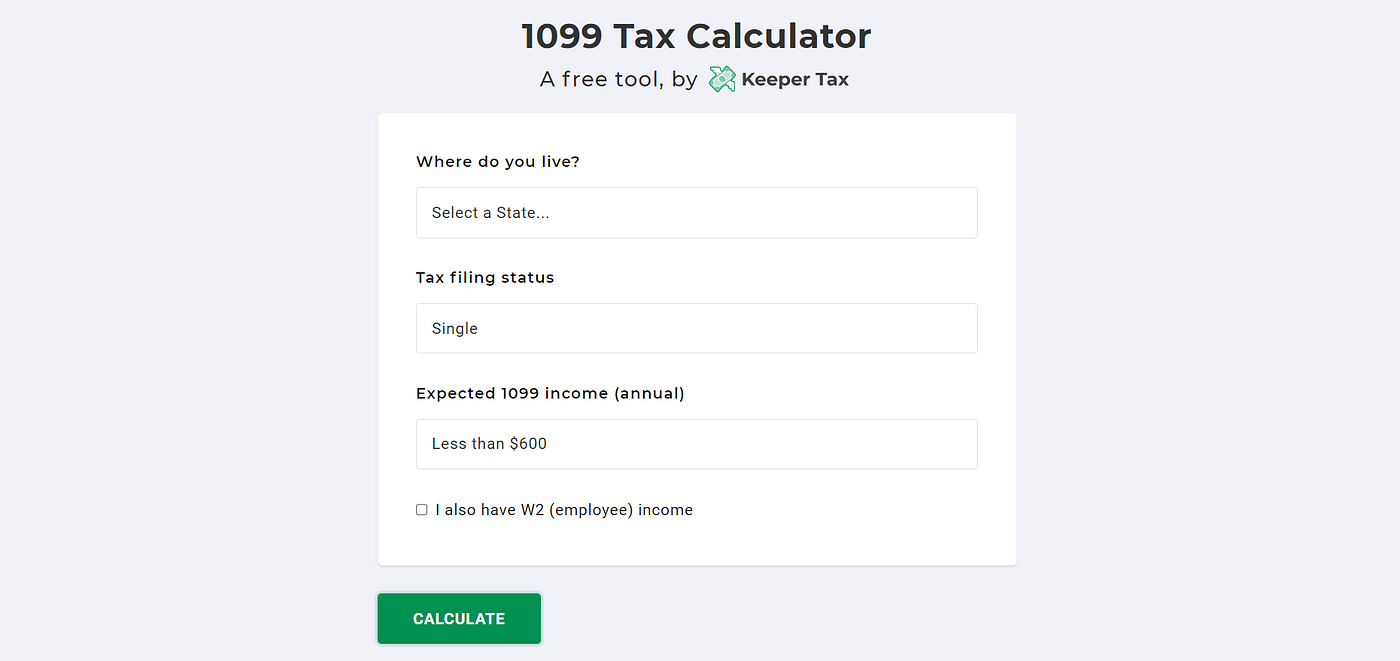

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

The self-employment tax rate is currently 153 of your income.

. Real Estate Tax. File a 2019 Return Today. It is mainly intended for residents of the US.

For example 1099-DIV informs the IRS that you were paid potentially taxable dividend income. When figuring out what tax bracket youre in you look at the highest tax rate applied to the top portion of your taxable income for your filing status. How To Prepare eFile a Tax Return with Form 1099 Income.

Available in mobile app only. February 1 Due Date to IRS. There are free online state income tax filing options available to you including the DRS Taxpayer Service Center.

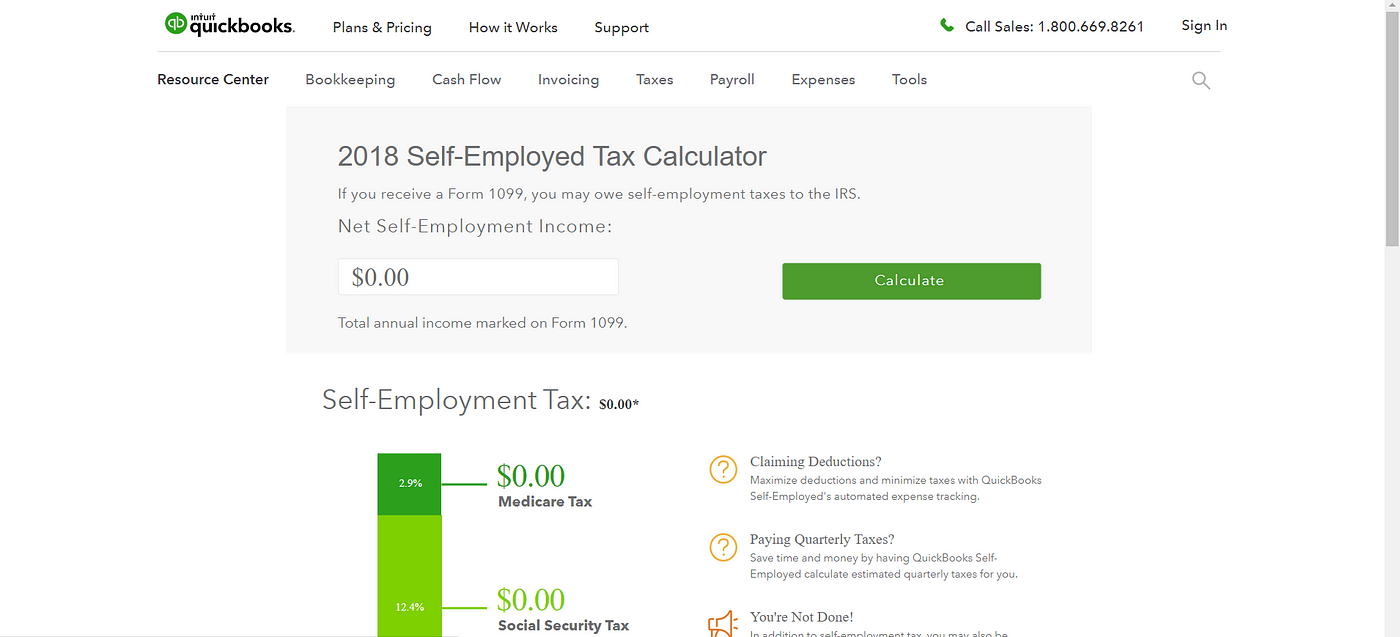

File Your 2021 Connecticut Income Tax Return Online. Self-employment tax consists of 124 going to Social Security and 29 going to Medicare. Federal Income Tax Return Calculator.

Available in TurboTax Self-Employed and TurboTax Live Self-Employed. If youre self-employed or work as an independent contractor you typically report your income including that from forms 1099-K on Schedule C of your Form 1040 individual income tax return. However you dont necessarily have to report this amount on your federal tax return or pay additional federal taxes.

We will determine the correct forms to use based on your answers to a simple tax interview. - You made 400 in self-employed1099 income. Click the following link to access our 2021 income tax calculator.

You may also want to see these instructions to prepare and eFile a tax return with 1099 income. See how various types of IRS Form 1099 work. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

Available in TurboTax Self-Employed and TurboTax Live Self-Employed. Were proud to provide one of the most comprehensive free online tax calculators to our users. Feature available within Schedule C tax form for TurboTax filers with 1099-NEC income.

Try paystub maker and get first pay stub for free easily in 1-2-3 steps. Print Income Tax Forms. If your net church employee income or total church income subject to self-employed tax is under 100 you will not owe any self-employment taxes.

Income Tax Payments Leave blank if unknown Total tax withheld from forms W-4 and 1099. Most individuals and businesses in the United States are obligated to pay taxes and file tax forms to the Federal government. If your business is organized as a pass-through entity like a multi-member LLC LLC electing to be treated as a corporation S Corp or Partnership you.

Income Taxes By State. Before you FileIT your 2019 Return use our 2019 Tax Calculator to estimate your 2019 Tax Refund or Taxes Owed. The term tax bracket refers to the income ranges with differing tax rates applied to each range.

A 1099 form is a tax record that an entity or person not your employer gave or paid you money. About Publication 505 Tax Withholding and Estimated Tax. Lowest price automated accurate tax calculations.

Any income thats reported on a 1099-NEC or 1099K is considered self-employment income Self-employment income is just code for non-W-2 It can come from running a small business freelancing or just working a casual side hustle. It is not necessary to attach the 1099-G to your tax return. 1099-MISC income from other sources used by self-employed individuals.

The federal income tax system is progressive which means that tax rates go up the greater taxable income you have. Connecticut Alternative Minimum Tax Return. A simple tax return is one thats filed using IRS Form 1040 only without having to attach any forms or schedules.

Do you get 1099 forms if you make under 600. W-2 income Limited interest and dividend income reported on a 1099-INT or 1099-DIV IRS standard deduction. You have until April 15 2023 to claim your 2019 tax refund.

Due Date to Recipient. The Federal Income Tax. Only certain taxpayers are eligible.

A simple tax return is one thats filed using IRS Form 1040 only without having to attach any forms or schedules. 1099-R StateLocal Tax Rate. Calculator Guide A Guide To The 1040 Tax Form Frequent Tax Questions.

Use the 2019 forms below to prepare your 2019 Return. And is based on the tax brackets of 2021 and 2022. They can file one for a lower amount but since most people arent eager to fill out more tax forms they usually dont.

1099-NEC Snap and Autofill. Substitute for Forms W-2 and 1099-R. The Indiana income tax has one tax bracket with a maximum marginal income tax of 323 as of 2022.

If you eFile all of your paperwork inluding your W2 and 1099 forms and even your payments via direct debit credit card or echeck can be. If you dont get a Form 1099-NEC from one of your clients. Dozens of special situations call for a Form 1099 but they all cover payments you receive that may.

The following income chapter 3 status and Limitation on benefits LOB codes were added to Form 1042-S. For the full details check out the IRSs clarification. Total tax withheld from forms W-2 and 1099.

What does it mean to have 1099 income. New income code 56 was added to address section 871m transactions resulting from combining transactions under Regulations section 1871-15n including as modified by transition relief under Notice 2020-2. If your net earnings from self-employment were less than 400 you still have to file an income tax return if you meet any other filing requirement listed in the Form 1040 and 1040-SR instructions PDF.

The good news is that you can deduct half of the amount you pay in self-employment tax from your income on your Form 1040. Individuals including sole proprietors partners and S corporation shareholders generally have to make estimated tax payments if they expect to owe tax of 1000 or more when their return is filed While the annual return. Key Takeaways When you provide 600 or more in services to a business that client is usually required to report your earnings by issuing Form 1099-NEC.

Changes to Form 1042-S. Situations covered assuming no added tax complexity. W-2 income Limited interest and dividend income reported on a 1099-INT or 1099-DIV IRS standard deduction.

This product feature is only. Estimated tax payments. In the 22 tax bracket that would mean an income tax savings of 330.

Form 1099-C reports the cancellation of a debt which is sometimes a taxable event and Form 1099-NEC reports payments to independent contractors. Worked as a rideshare driver food delivery person freelance writer or other gig worker or independent. My total tax payments.

Income Tax Calculator. For reporting nonemployee compensation such as income earned as an independent contractor freelancer or self-employed individual. Understanding Your Form 1099-K.

Income Tax Calculator. You dont owe taxes on side hustles. About Publication 225 Farmers Tax.

When youre being paid by a client theyre only required to file a 1099 form if you earned more than 600 from them in a calendar year. Use our free check stub maker with calculator to generate pay stubs online instantly. For example 3000 in self-employment tax reduces your taxable income by 1500.

Only certain taxpayers are eligible. Situations covered assuming no added tax complexity.

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

:max_bytes(150000):strip_icc()/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Form 1099 Misc Miscellaneous Income Definition

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Top 8 Freelance Tax Calculators To Help You Save The Most Freelancer S Handbook

Estimated Tax Payments For Independent Contractors A Complete Guide

Onlyfans 1099 Taxes How To Properly File

Tax Calculator Estimate Your Income Tax For 2022 Free

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Form 1099 Misc Miscellaneous Income Definition

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Tax Refund Estimator Calculator For 2021 Return In 2022

/1099B2022-95af0a55817a4b8ea69f159a8c8451c1.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition

:max_bytes(150000):strip_icc()/1099B2022-95af0a55817a4b8ea69f159a8c8451c1.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition

Self Employed Tax Calculator Business Tax Self Employment Self

Top 8 Freelance Tax Calculators To Help You Save The Most Freelancer S Handbook